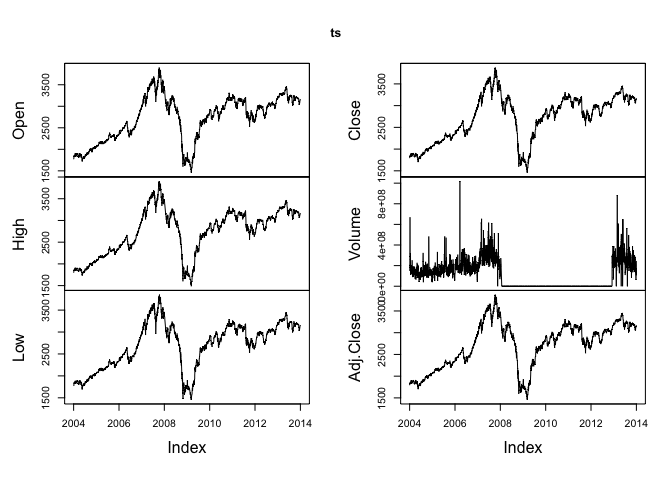

A data file contains daily values of the Straits Times Index (STI) from 1 Jan’04 to 31 Dec’13 . The fields are: – Date – Opening Price – Closing Price – Adjusted Close (similar to above but after minor accounting changes) – Highest value during the day – Lowest value during the day – Volume (total amount of traded stocks during the day)

Goal: The goal is to predict the short term STI trend with sufficient accuracy for profitable use in a (simplified) trading scenario

data <- read.csv("STI 2004-2013.csv")

head(data)

## Date Open High Low Close Volume Adj.Close

## 1 2013-12-31 3166.26 3169.20 3158.15 3167.43 245359800 3167.43

## 2 2013-12-30 3159.68 3164.86 3150.26 3153.29 107880500 3153.29

## 3 2013-12-27 3144.87 3154.82 3142.37 3149.76 174566000 3149.76

## 4 2013-12-26 3131.94 3138.15 3130.23 3134.36 61807500 3134.36

## 5 2013-12-24 3124.47 3131.80 3115.41 3127.29 78827000 3127.29

## 6 2013-12-23 3101.92 3116.22 3096.92 3116.22 122500700 3116.22

Coverting the data into zoo (time series)

library(zoo)

##

## Attaching package: 'zoo'

## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric

dates = data$Date

data$Date = NULL

ts = zoo(data, as.Date(dates, "%Y-%m-%d"))

head(ts)

## Open High Low Close Volume Adj.Close

## 2004-01-02 1768.78 1795.63 1768.77 1791.35 148575200 1791.35

## 2004-01-05 1797.75 1831.63 1782.97 1828.66 207981200 1828.66

## 2004-01-06 1838.41 1856.91 1824.78 1828.72 199559800 1828.72

## 2004-01-07 1821.27 1839.94 1820.34 1835.96 667266000 1835.96

## 2004-01-08 1838.04 1853.80 1837.04 1841.68 287469400 1841.68

## 2004-01-09 1859.92 1867.63 1848.86 1852.53 290463000 1852.53

plot(ts)

creating weekly trend variables

wkgain = diff(ts, lag=7)

head(wkgain)

## Open High Low Close Volume Adj.Close

## 2004-01-13 80.78 65.93 75.54 70.21 110340000 70.21

## 2004-01-14 58.75 40.64 70.93 31.87 110594800 31.87

## 2004-01-15 25.12 10.38 3.30 1.26 97768800 1.26

## 2004-01-16 13.73 5.96 12.75 0.91 -499221400 0.91

## 2004-01-19 10.84 -1.65 -3.31 7.53 -178171000 7.53

## 2004-01-20 -4.74 0.60 0.35 12.91 -160634200 12.91

additional target variable

- tommorows closing STI

- the percentage increase or decrease in STI from today to tommorow

- the trend: +1(increasing), -1(decreasing), 0(nochange)

wkgain$tominc = diff(ts$Close, lag=-1)

wkgain$tomclose = ts$Close + wkgain$tominc

wkgain$tomtrend = wkgain$tominc/abs(wkgain$tominc)

wkgain$tominc = (wkgain$tominc *100)/ts$Close

adding wgain to original data

ts = cbind(ts, wkgain)

head(ts,20)

## Open.ts High.ts Low.ts Close.ts Volume.ts Adj.Close.ts

## 2004-01-02 1768.78 1795.63 1768.77 1791.35 148575200 1791.35

## 2004-01-05 1797.75 1831.63 1782.97 1828.66 207981200 1828.66

## 2004-01-06 1838.41 1856.91 1824.78 1828.72 199559800 1828.72

## 2004-01-07 1821.27 1839.94 1820.34 1835.96 667266000 1835.96

## 2004-01-08 1838.04 1853.80 1837.04 1841.68 287469400 1841.68

## 2004-01-09 1859.92 1867.63 1848.86 1852.53 290463000 1852.53

## 2004-01-12 1845.84 1852.07 1837.82 1842.49 176869200 1842.49

## 2004-01-13 1849.56 1861.56 1844.31 1861.56 258915200 1861.56

## 2004-01-14 1856.50 1872.27 1853.90 1860.53 318576000 1860.53

## 2004-01-15 1863.53 1867.29 1828.08 1829.98 297328600 1829.98

## 2004-01-16 1835.00 1845.90 1833.09 1836.87 168044600 1836.87

## 2004-01-19 1848.88 1852.15 1833.73 1849.21 109298400 1849.21

## 2004-01-20 1855.18 1868.23 1849.21 1865.44 129828800 1865.44

## 2004-01-21 1879.54 1893.99 1871.05 1889.56 142273100 1889.56

## 2004-01-26 1901.30 1905.16 1883.84 1899.98 206612400 1899.98

## 2004-01-27 1909.00 1912.93 1888.63 1904.55 155241600 1904.55

## 2004-01-28 1899.89 1899.89 1859.40 1862.84 137608200 1862.84

## 2004-01-29 1849.52 1849.52 1834.60 1842.32 161401200 1842.32

## 2004-01-30 1853.38 1859.58 1841.14 1848.36 120572700 1848.36

## 2004-02-03 1835.12 1847.04 1817.46 1845.13 184695200 1845.13

## Open.wkgain High.wkgain Low.wkgain Close.wkgain Volume.wkgain

## 2004-01-02 NA NA NA NA NA

## 2004-01-05 NA NA NA NA NA

## 2004-01-06 NA NA NA NA NA

## 2004-01-07 NA NA NA NA NA

## 2004-01-08 NA NA NA NA NA

## 2004-01-09 NA NA NA NA NA

## 2004-01-12 NA NA NA NA NA

## 2004-01-13 80.78 65.93 75.54 70.21 110340000

## 2004-01-14 58.75 40.64 70.93 31.87 110594800

## 2004-01-15 25.12 10.38 3.30 1.26 97768800

## 2004-01-16 13.73 5.96 12.75 0.91 -499221400

## 2004-01-19 10.84 -1.65 -3.31 7.53 -178171000

## 2004-01-20 -4.74 0.60 0.35 12.91 -160634200

## 2004-01-21 33.70 41.92 33.23 47.07 -34596100

## 2004-01-26 51.74 43.60 39.53 38.42 -52302800

## 2004-01-27 52.50 40.66 34.73 44.02 -163334400

## 2004-01-28 36.36 32.60 31.32 32.86 -159720400

## 2004-01-29 14.52 3.62 1.51 5.45 -6643400

## 2004-01-30 4.50 7.43 7.41 -0.85 11274300

## 2004-02-03 -20.06 -21.19 -31.75 -20.31 54866400

## Adj.Close.wkgain tominc tomclose tomtrend

## 2004-01-02 NA 2.082786725 1828.66 1

## 2004-01-05 NA 0.003281091 1828.72 1

## 2004-01-06 NA 0.395905333 1835.96 1

## 2004-01-07 NA 0.311553629 1841.68 1

## 2004-01-08 NA 0.589136006 1852.53 1

## 2004-01-09 NA -0.541961534 1842.49 -1

## 2004-01-12 NA 1.035012402 1861.56 1

## 2004-01-13 70.21 -0.055329938 1860.53 -1

## 2004-01-14 31.87 -1.642005235 1829.98 -1

## 2004-01-15 1.26 0.376506847 1836.87 1

## 2004-01-16 0.91 0.671794956 1849.21 1

## 2004-01-19 7.53 0.877672087 1865.44 1

## 2004-01-20 12.91 1.292992538 1889.56 1

## 2004-01-21 47.07 0.551451131 1899.98 1

## 2004-01-26 38.42 0.240528848 1904.55 1

## 2004-01-27 44.02 -2.190018640 1862.84 -1

## 2004-01-28 32.86 -1.101543879 1842.32 -1

## 2004-01-29 5.45 0.327847497 1848.36 1

## 2004-01-30 -0.85 -0.174749508 1845.13 -1

## 2004-02-03 -20.31 -0.568523627 1834.64 -1

remove some missing values

ts = na.omit(ts)

head(ts)

## Open.ts High.ts Low.ts Close.ts Volume.ts Adj.Close.ts

## 2004-01-13 1849.56 1861.56 1844.31 1861.56 258915200 1861.56

## 2004-01-14 1856.50 1872.27 1853.90 1860.53 318576000 1860.53

## 2004-01-15 1863.53 1867.29 1828.08 1829.98 297328600 1829.98

## 2004-01-16 1835.00 1845.90 1833.09 1836.87 168044600 1836.87

## 2004-01-19 1848.88 1852.15 1833.73 1849.21 109298400 1849.21

## 2004-01-20 1855.18 1868.23 1849.21 1865.44 129828800 1865.44

## Open.wkgain High.wkgain Low.wkgain Close.wkgain Volume.wkgain

## 2004-01-13 80.78 65.93 75.54 70.21 110340000

## 2004-01-14 58.75 40.64 70.93 31.87 110594800

## 2004-01-15 25.12 10.38 3.30 1.26 97768800

## 2004-01-16 13.73 5.96 12.75 0.91 -499221400

## 2004-01-19 10.84 -1.65 -3.31 7.53 -178171000

## 2004-01-20 -4.74 0.60 0.35 12.91 -160634200

## Adj.Close.wkgain tominc tomclose tomtrend

## 2004-01-13 70.21 -0.05532994 1860.53 -1

## 2004-01-14 31.87 -1.64200524 1829.98 -1

## 2004-01-15 1.26 0.37650685 1836.87 1

## 2004-01-16 0.91 0.67179496 1849.21 1

## 2004-01-19 7.53 0.87767209 1865.44 1

## 2004-01-20 12.91 1.29299254 1889.56 1

Dividing the data into test and train set

sta = as.Date("01-Jan-2000","%d-%b-%Y")

mid1 = as.Date("31-Dec-2011","%d-%b-%Y")

mid2 = as.Date("01-Jan-2012","%d-%b-%Y")

last = as.Date("31-Dec-2020","%d-%b-%Y")

traindata = window(ts, start=sta, end=mid1)

testdata = window(ts,start=mid2, end=last)

traindata = as.data.frame(traindata)

testdata = as.data.frame(testdata)

lets build the model

require(nnet)

## Loading required package: nnet

drops <- c("tominc","tomtrend")

ts1 <- ts[ , !(names(ts) %in% drops)]

names(ts1)

## [1] "Open.ts" "High.ts" "Low.ts"

## [4] "Close.ts" "Volume.ts" "Adj.Close.ts"

## [7] "Open.wkgain" "High.wkgain" "Low.wkgain"

## [10] "Close.wkgain" "Volume.wkgain" "Adj.Close.wkgain"

## [13] "tomclose"

ts1 <- as.data.frame(ts1)

fit1 <- nnet(tomclose ~., data=ts1, decay=0.01, maxit = 1000, size = 10,linout=TRUE)

## # weights: 141

## initial value 19016184447.115292

## iter 10 value 1187351525.482532

## iter 20 value 667513221.464708

## iter 30 value 649061699.190153

## iter 40 value 628835075.427959

## iter 50 value 619225302.992356

## iter 60 value 596712834.816838

## iter 70 value 575723314.136651

## iter 80 value 524332622.058288

## iter 90 value 464642145.063168

## iter 100 value 452729230.725534

## iter 110 value 452297868.666327

## iter 120 value 452026856.251722

## iter 130 value 451903798.419287

## iter 140 value 451842035.995465

## iter 150 value 451802410.999621

## iter 160 value 451788615.860967

## iter 170 value 451476313.894100

## iter 180 value 451435669.859691

## iter 190 value 451416515.200648

## iter 200 value 451346230.863645

## iter 210 value 451236680.828900

## iter 220 value 451027438.303944

## iter 230 value 450717623.571131

## iter 240 value 450712204.209646

## iter 250 value 450701219.144414

## iter 260 value 450698446.241577

## iter 270 value 450694746.958901

## iter 280 value 450693600.075649

## iter 290 value 450692240.368372

## iter 300 value 450691808.174171

## iter 310 value 450690374.722819

## final value 450690257.867463

## converged

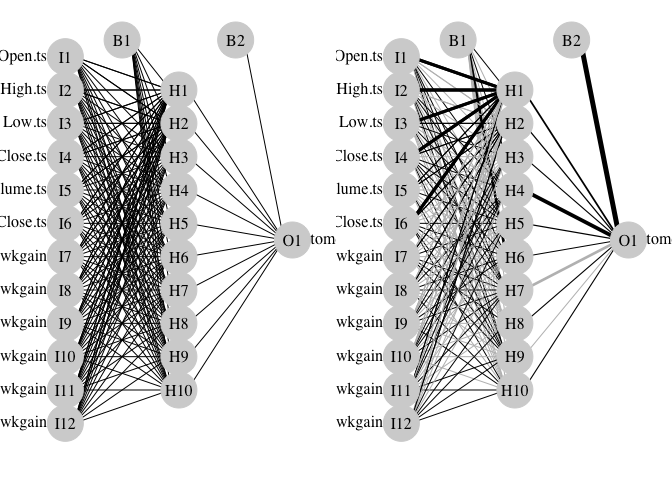

lets do some visualization of network

Installing packages

#import function from Github

require(RCurl)

## Loading required package: RCurl

## Loading required package: bitops

root.url<-'https://gist.githubusercontent.com/fawda123'

raw.fun<-paste(

root.url,

'5086859/raw/cc1544804d5027d82b70e74b83b3941cd2184354/nnet_plot_fun.r',

sep='/'

)

script<-getURL(raw.fun, ssl.verifypeer = FALSE)

eval(parse(text = script))

rm('script','raw.fun')

par(mar=numeric(4),mfrow=c(1,2),family='serif')

plot(fit1,nid=F)

## Loading required package: scales

plot(fit1)

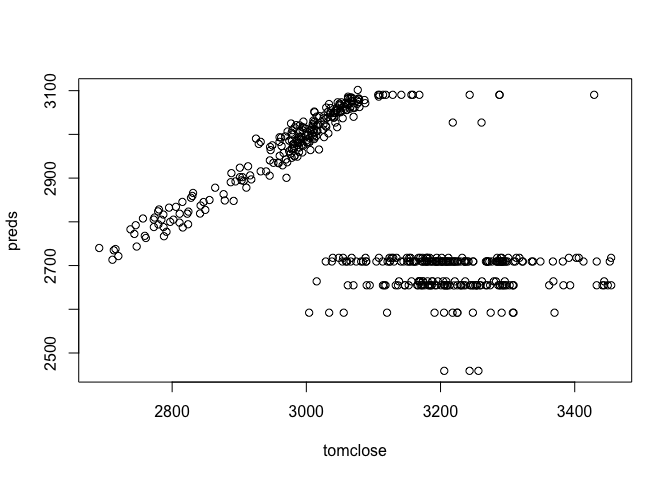

Lets Predict

test2 <- testdata[ , !(names(testdata) %in% drops)]

preds <- predict(fit1, newdata = test2[1:12])

predpair = cbind(test2[13],preds)

plot(predpair)

errors = apply(predpair, 1, function(row) abs(row[1]-row[2]))

cat(sprintf("mean abs error=%f\n", mean(errors)))

## mean abs error=285.548083

predinc = preds - testdata["Close.ts"]

predtrend = predinc/abs(predinc)

table(testdata$tomtrend, predtrend[,1], dnn = c("Actual","Predicted"))

## Predicted

## Actual -1 1

## -1 148 78

## 1 186 84